Get in Touch

Tell us about yourself and we will get back to you as soon as we can.

Tell us about yourself and we will get back to you as soon as we can.

As more companies move their financial operations into the cloud, the demand for cloud-based accounting and bookkeeping software with artificial intelligence (AI) capabilities is rising. Today, businesses expect tools that do more than simply digitize receipts or categorize transactions. They want platforms that deliver real-time insights, forecasting, and automation so they can focus on growth rather than reconciling spreadsheets.

In this article we compare four leading platforms: LayerNext, Zeni.ai, Bookeeping.ai, and QuickBooks with its newer AI features. The goal is to give you a clear, evidence-based view of each tool, how they stack up, and why LayerNext offers the strongest proposition for many small to mid-sized businesses.

AI bookkeeping refers to accounting tools that go beyond manual entry and rule-based automation. Instead, they apply machine learning (ML), pattern recognition, and intelligent automation to tasks such as:

Academic research supports that AI and ML are dramatically changing financial accounting by enabling more accurate, real-time financial reporting.

As companies grow, relying on manual bookkeeping becomes a bottleneck. AI bookkeeping helps reduce human error, accelerate month-end closing, and free up time for strategic finance.

From search trends and user reviews, the key features businesses are looking for include:

When evaluating tools, we’ll use those criteria to compare performance.

Here is a brief summary of the four platforms we examine

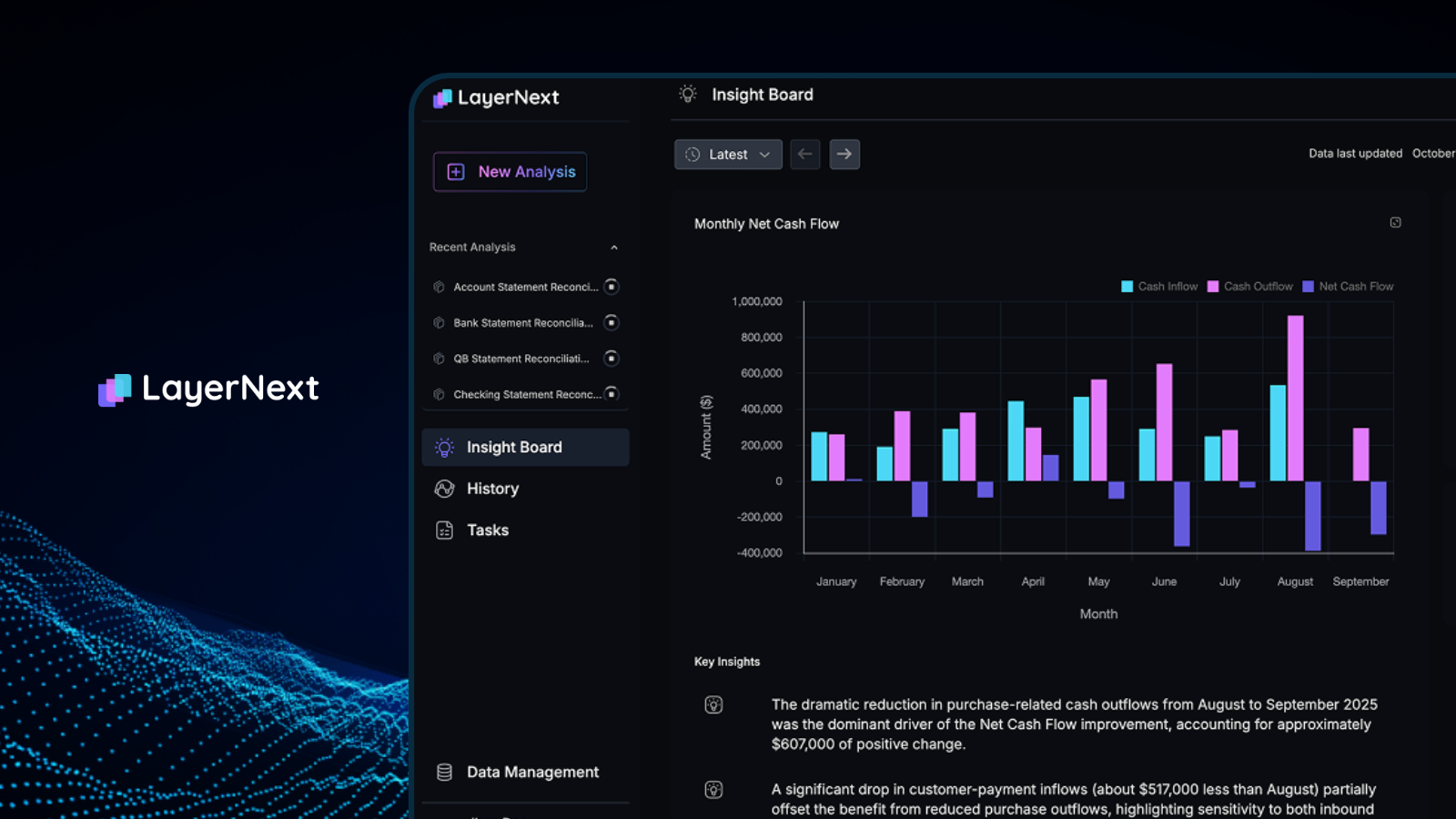

LayerNext is an AI CFO platform that keeps your finances accurate, up to date, and ready for decisions in real time. It automatically categorizes transactions, reconciles accounts, and maintains clean books by integrating directly with QuickBooks. This makes LayerNext one of the most advanced AI-driven financial systems available today.

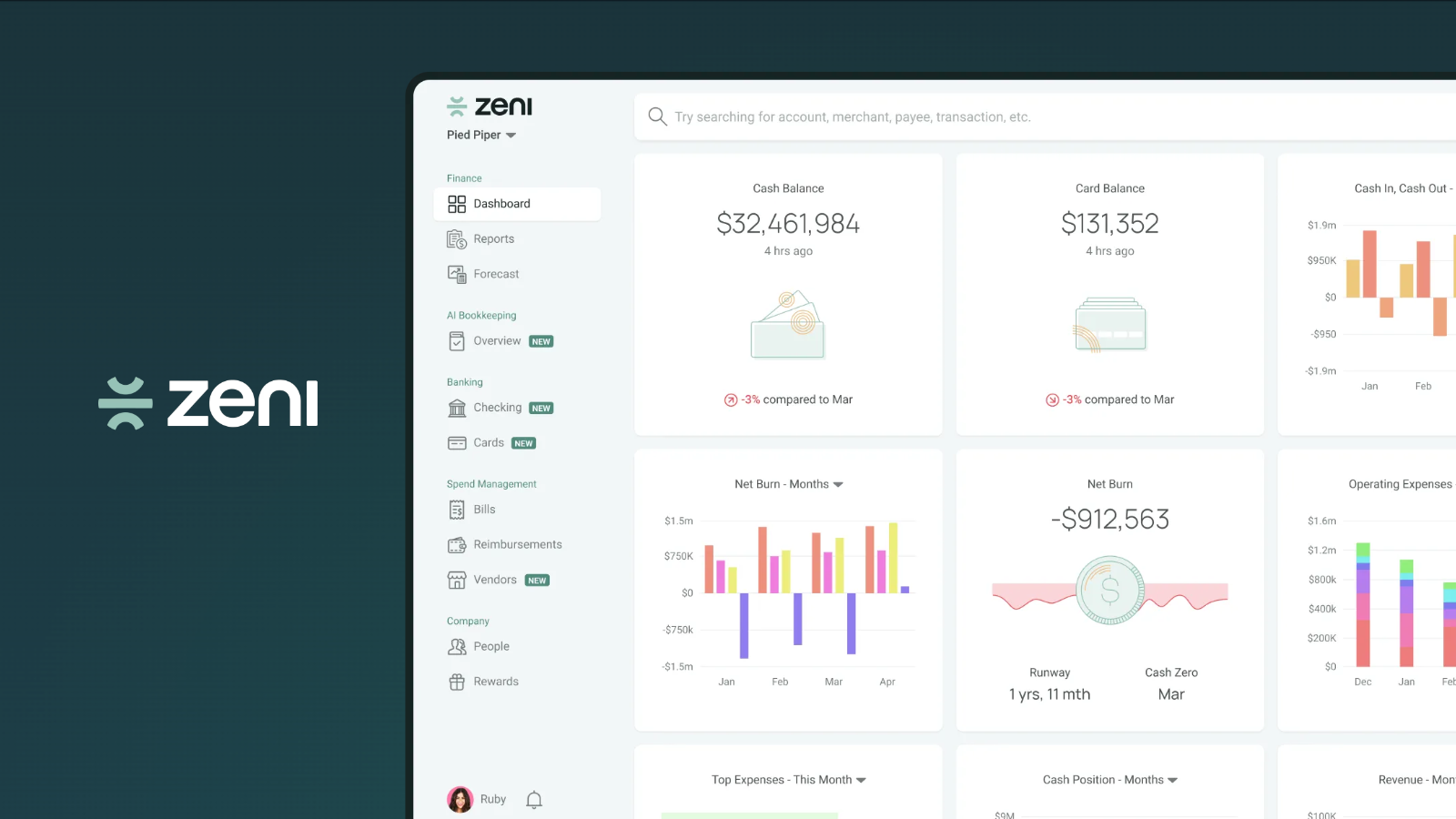

A finance operations platform that combines AI bookkeeping with human support, aimed at startups, especially SaaS businesses. Zeni describes multiple “AI Agents” (CFO Agent, Accountant Agent, etc.) and offers real-time sync and reconciliation.

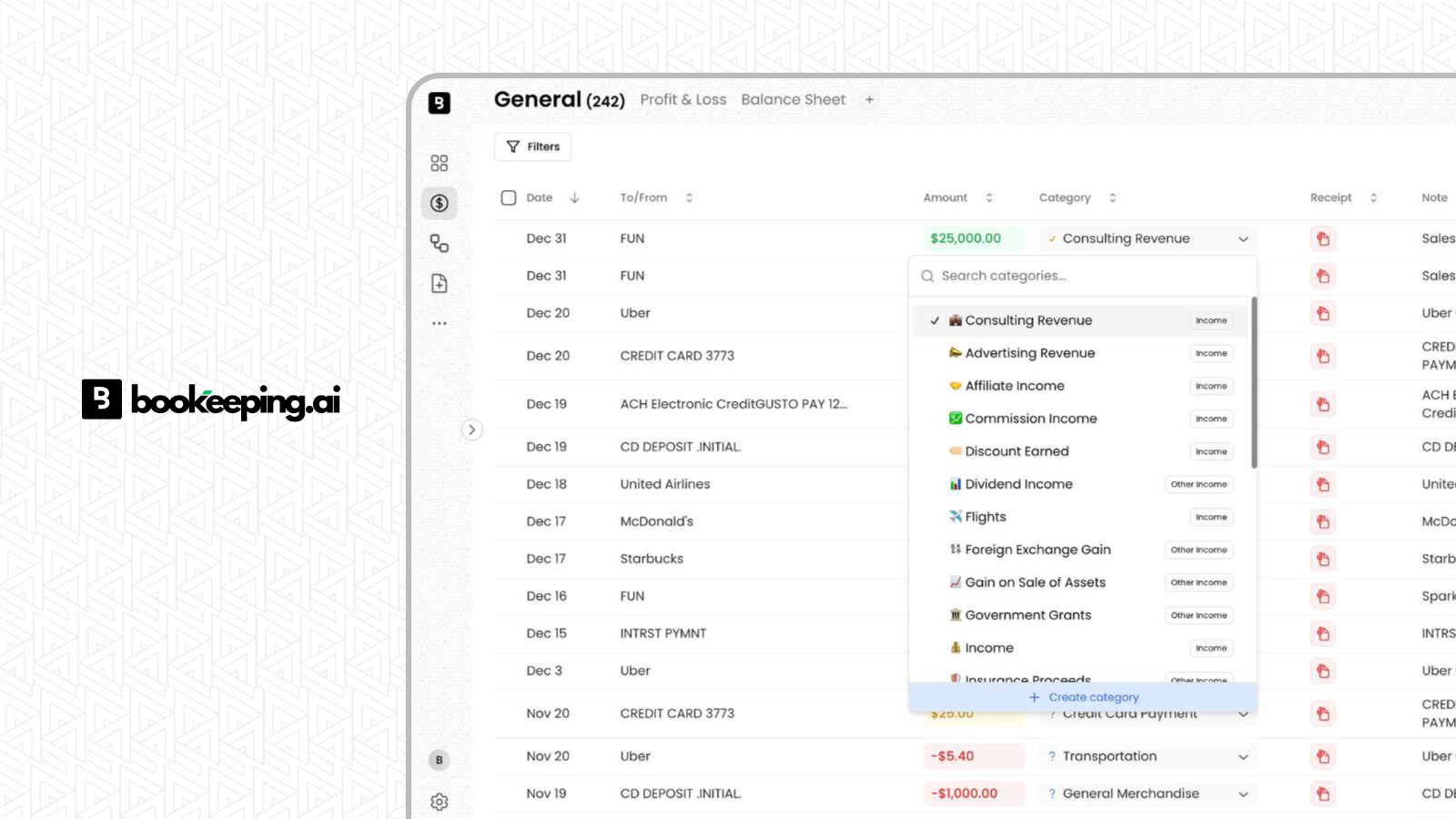

A platform built around an AI assistant (“Paula”) that automates bookkeeping tasks for small businesses and freelancers. It emphasizes “Automate your bookkeeping with Bookeeping.ai. Chat with your AI to create reports, send invoices, and manage finances effortlessly.”

The widely used accounting software from Intuit which is rolling out AI-powered agents as part of its platform. Official updates show “AI agents” such as Accounting Agent, Payments Agent, Customer Agent, Finance Agent.

LayerNext is not just another AI bookkeeping tool. It is the first platform built as a fully autonomous AI CFO, designed to maintain your books in real time and deliver financial clarity without human intervention. Unlike other systems that still rely on rules, manual adjustments, or outsourced teams, LayerNext uses a multi-agent financial intelligence engine that continuously categorizes transactions, reconciles accounts, and closes your books automatically.

This means businesses operate with always-updated financials, no month-end close, no catch-up work, and no hidden backlog. LayerNext gives founders, operators, and small business teams the level of visibility that previously required a full finance department.

Beyond automation, LayerNext provides CFO-grade intelligence: cash flow forecasting, burn rate and runway analysis, margin breakdowns, spending insights, and real-time warnings about financial risks. It behaves like a modern CFO, not a rules engine.

Designed for small and mid-sized businesses, LayerNext offers transparent pricing and a simple, cloud-first experience that anyone can set up in minutes. It is built for operators who want to focus on running their business, not managing spreadsheets or coordinating with bookkeepers.

Zeni positions itself as a full finance operations partner with a blend of AI automation and human financial expertise. The platform is structured around daily bookkeeping, real-time updates, and dedicated support, making it appealing to venture-backed startups or businesses that need both automated workflows and hands-on guidance. Zeni.ai’s model aims to give companies a near-outsourced finance team while still benefiting from AI-driven insights and streamlined operations.

Its strength lies in pairing AI-enabled systems with human oversight, though this results in a more service-heavy model compared with AI-first automation platforms. While powerful for complex financial environments, the structure can introduce higher costs and slower turnaround times for routine tasks. Zeni is best suited for fast-growing startups that require white-glove finance operations rather than businesses seeking fully autonomous AI bookkeeping or AI CFO systems.

Bookeeping is built for simplicity, offering a straightforward AI-driven bookkeeping solution primarily targeting small businesses, freelancers, and solo operators. Its automation focuses on classifying transactions, generating core financial statements, and maintaining updated financial records with minimal user intervention. The platform emphasizes ease of use and accessibility for users who want bookkeeping handled without complexity.

While intuitive and affordable, Bookeeping does not provide the depth of financial intelligence or automation power seen in more sophisticated AI bookkeeping or AI CFO platforms. It performs well for routine bookkeeping tasks but lacks more advanced capabilities such as forecasting, long-term analysis, or deeper financial modeling. For micro-businesses, this balance may be ideal, but larger or rapidly growing companies may eventually require greater automation and strategic insight.

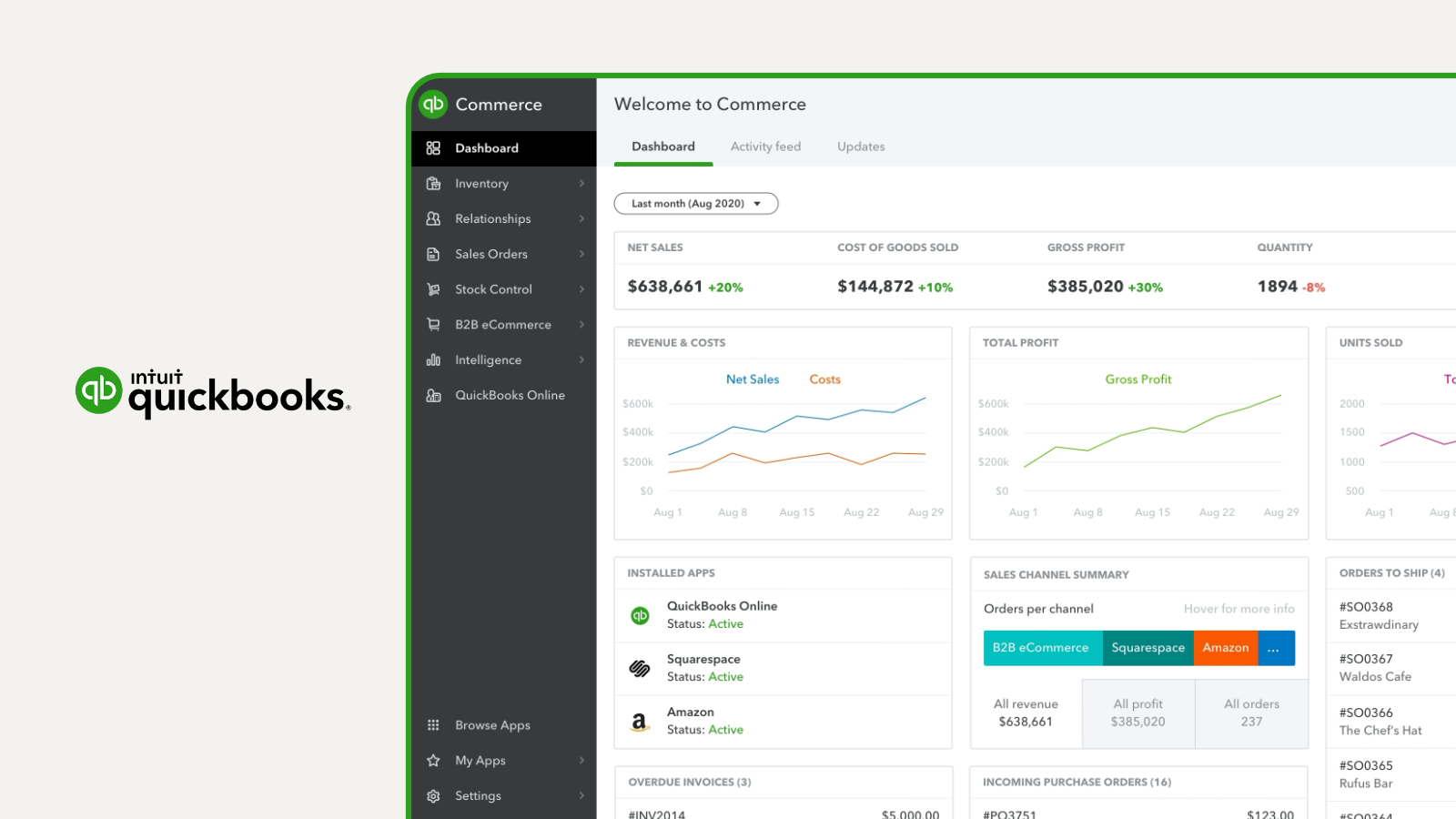

QuickBooks remains one of the most widely used accounting platforms in the world, with an extensive ecosystem and a strong foundation in traditional bookkeeping and financial reporting. Recent enhancements have introduced AI-powered functionalities that automate categorization, support reconciliation, and improve financial workflows. These additions make QuickBooks more intuitive and capable for everyday small-business bookkeeping needs.

However, QuickBooks’ AI implementation remains assistive rather than fully autonomous. Its AI features enhance traditional workflows but do not yet function as a complete AI CFO or continuous close system. While the platform excels in integrations, reliability, and general accounting capabilities, its AI features are still evolving and may require higher-tier plans to unlock advanced functionality. For businesses already embedded in the QuickBooks ecosystem, these improvements provide meaningful value, though not the level of automation found in AI-first platforms.

LayerNext distinguishes itself by delivering true end-to-end automation rather than incremental AI assistance. Its multi-agent intelligence continuously categorizes transactions, reconciles accounts, and maintains real-time financial accuracy without requiring manual intervention. While many platforms offer AI-enhanced workflows, LayerNext moves beyond enhancement and into autonomy, operating as a continuous, self-managing financial engine.

In addition to automating bookkeeping, LayerNext provides deep financial insights that mirror the strategic visibility of a modern CFO. Businesses gain instant access to meaningful indicators such as cash-flow health, burn rate, runway projections, margin performance, and operational trends. Competitors may offer dashboards, but few deliver this level of forward-looking analysis designed to support faster, better decision-making.

LayerNext provides a clear, transparent pricing model that makes advanced automation and AI-driven financial intelligence attainable for a wide range of small and mid-sized businesses. Many competing tools rely on service-heavy models or complex pricing structures. LayerNext instead removes ambiguity, offering a straightforward entry point that allows businesses to benefit from cutting-edge automation without hidden costs or long-term contracts.

Unlike tools that prioritize large enterprises or human-led services, LayerNext is purpose-built for founders, operators, and small business teams who need accurate, always-ready financial information. Its system adapts to dynamic operational patterns and keeps financials consistently updated, making it especially valuable for organizations that want clarity and control without dependence on external bookkeeping services.

LayerNext delivers a frictionless cloud-based workflow designed for modern businesses. It connects easily to accounting systems, banking data, and financial tools, enabling rapid setup and smooth daily operation. This simplicity allows users to transition from manual or semi-automated bookkeeping systems into a fully automated, cloud-native environment with minimal onboarding effort.

The shift toward AI-driven financial management is accelerating, and businesses are increasingly moving from manual bookkeeping and legacy accounting tools to automated, cloud-first financial systems. Among the platforms evaluated, LayerNext delivers the most compelling combination of continuous automation, intelligent financial insights, and modern usability. It empowers businesses with accurate, always-updated financials and real-time CFO-level visibility, making it one of the strongest options available for small and mid-sized organizations.

For companies seeking to reduce manual work, streamline financial operations, and gain deeper strategic clarity, LayerNext offers a future-ready solution that fits the needs of modern operators and growth-focused teams.